News

Guaranteed losses

By Michael O’Connor from theislandinvestor.com

It's human nature to focus on the most recent news and react to our present environment.

Where we go wrong is our tendency to extrapolate this current environment out into the future, assuming it will last forever.

During the good times, we get caught up in the euphoria. We think things will last forever, and we find ways to rationalise even the most ludicrous narratives. Lest we forget, people were finding seemingly justifiable reasons to pay millions of dollars for pictures of cartoon rocks less than a year ago.

This tendency to extrapolate works both ways. It's easy to get caught up in the downward spiral of bad news and buy into the doomsday scenarios.

The imminent collapse of Fiat Currency, World War 3 and a Global Debt Crisis all become seemingly guaranteed outcomes when outlooks turn negative.

But nothing lasts forever, and the current environment we are in will not be the exception to the rule.

This too shall pass. While it may seem inevitable when you are stuck in the echo chamber of endless bad news, in reality, it is far less likely to lead to an apocalypse than the doomsday preacher would like you to believe.

So, where does that leave investors?

You're looking in the wrong direction.

No need to regurgitate the negative news. It's everywhere. This symphony of pessimism has led to considerable market stress, with stock and bond indexes down over 20% YTD.

But that is what has already happened. You get no special prize for regaling what is currently happening or what has happened in the past.

The stock market is a forward-looking machine, so you must align your focus accordingly. As markets fall, you should ask yourself, what does all this mean for the future? How will things look one, three, or five years down the road?

As prices fall, fear increases but so too does the future expected return. Present-day turmoil creates future opportunities. For those not of retirement age, 30% market declines should be met with open arms and viewed as buying opportunities.

Investing is still too risky

Banks are boasting 0% deposit rates while inflation hits double figures. The price of everything around you skyrockets while the absolute value of your money stays the same.

Times have changed. Your money isn't 'safe' in the bank, you are simply locking in guaranteed losses. You need to be proactive. Doing nothing with your money is no longer an option. If you want to maintain your current wealth, it needs to be tied to assets that generate positive returns over time.

This isn't about taking maximum risk of finding the optimal investment that will make you rich overnight. You simply need to realise that you are willingly losing your hard-earned money by doing nothing.

Recent market activity has created opportunities for even the most risk-averse investor. As a result of the rise in interest rates, there are risk free investments now offering between 4% and 6% annual. These are far from the most lucrative assets, but they are a significant improvement from the 0% you are getting from the bank without any increase in credit risk.

If the potential to lose money is the thing preventing you from investing in the stock market, please realise that you are already making guaranteed losses as the value of your money erodes in the bank. Cash is the worst-performing asset class in history.

Don't worry about making the perfect first step. Inaction is the real enemy here. Simply focus on finding an investment better than your current deposit account and work from there. It won't be hard to find.

Focus on improvement, not perfection.

For free weekly stock tips and direct access to my personal investment portfolio, go to www.theislandinvestor.com.

News

Two Mary Immaculate College students win awards

Two Killarney students were honoured at the Mary Immaculate College Awards Ceremony in Limerick this week, with Dr Crokes footballer Leah McMahon and MIC Thurles student Setanta O’Callaghan both receiving […]

News

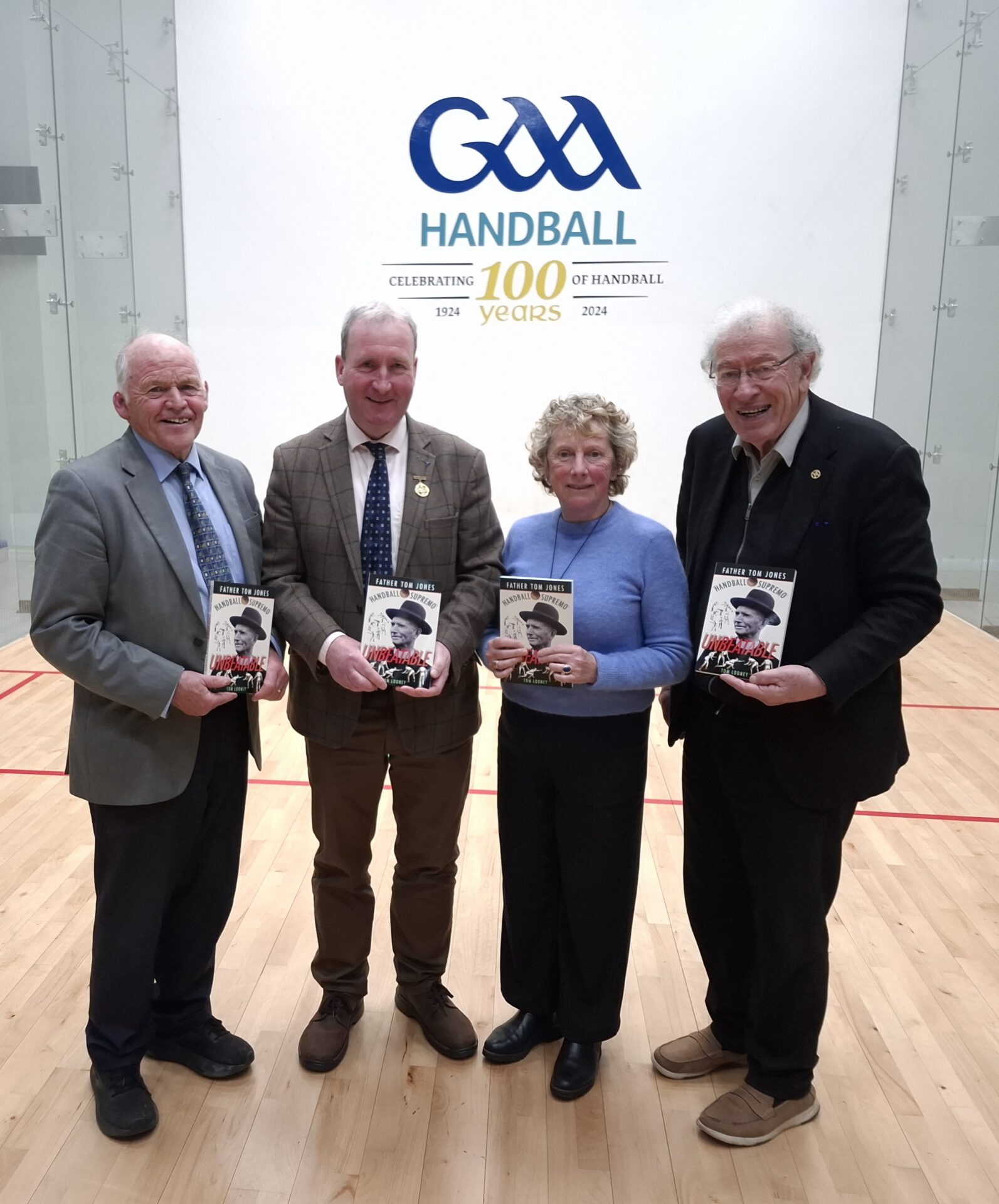

Book on handball legend to be launched at The Sem

A new book by a Killarney priest will be officially launched at St Brendan’s College on Monday, December 9. Unbeatable – Fr Tom Jones, Handball Supremo will be launched at […]