News

Are you saving too much?

By Michael O’Connor

Working in the finance space, I get a lot of questions about savings such as am I saving enough, how much do I need to save for retirement, and how can I save more?

And I get it; uncertainty around money can be one of the leading causes of stress.

According to Northwestern Mutual's 2018 Planning & Progress Study, 48% of US adults experienced "high" or "moderate" levels of anxiety around their level of savings.

Increasing your savings can be a sure-fire way to provide the peace of mind necessary to alleviate this stress.

But is there a downside here?

Does our preoccupation with savings inhibit other areas of our lives and at what point does saving money have diminishing rates of utility?

The allure of early retirement cannot be denied; paying your mortgage off a few years early is compelling, but continuously foregoing what you want now in the name of saving for 'the future' may not be as necessary as we think.

Despite the anxiety and focus around saving, the evidence suggests that many individuals seem to be saving too much.

Recent studies from the Investment and Wealth Institute have shown that only one in seven retirees are withdrawing principal from their retirement within a given year. The remaining retirees live off of their investments or even less.

According to a study by United Income, 'The average retired adult who dies in their 60s leaves behind $296k in net wealth, $313k in their 70s, $315k in their 80s, and $238k in their 90s'.

In short, retiree wealth tends to go up, not down, with age.

This suggests that more people should be asking, "Am I saving too much?" rather than "Am I saving enough?"

Stop guessing and make a plan.

Financial planning is not simply about blindly saving as much as possible. Your finances should facilitate your life, not perpetually inhibit it until such time as you have saved an arbitrary amount that you deem adequate enough to allow you do the things you want.

So, where do you start?

Unfortunately, there is no one-size-fits-all answer. It depends on your own personal situation, your income and your lifestyle.

With that said, there are general benchmarks that can be used when assessing your savings levels.

Start saving 6% at age 25 and ramp up savings by one percent each year until reaching an appropriate level, typically around 15%, including any employer contributions.

Savings of between 1 and 1.5 times your current gross wage at age 35 is a solid target to aim for.

Most people looking to retire around the age of 65 should aim for assets totalling between seven and 13-and-a-half times their pre-retirement gross income.

These general numbers won't apply to everyone, and a more robust financial plan is essential, but this should help to get the ball rolling.

A more in-depth financial plan should incorporate future project earnings, inheritance, the progressive compounding of your investments over time and the reduction in your spending rate over time as you move away from your most capital-intensive years.

It is essential that you take the time to figure out what you are truly saving for. Clarity around your exact requirement will ensure you strike the balance between spending in the present and saving smartly for the future.

To learn more about how to get started go to www.theislandinvestor.com.

News

Dr Crokes’ festive community initiatives

Dr Crokes GAA Club, a recent Gold Award winner in the GAA Healthy Club Honours 2025-2027, has announced a detailed programme of community initiatives for the Christmas season. The club […]

News

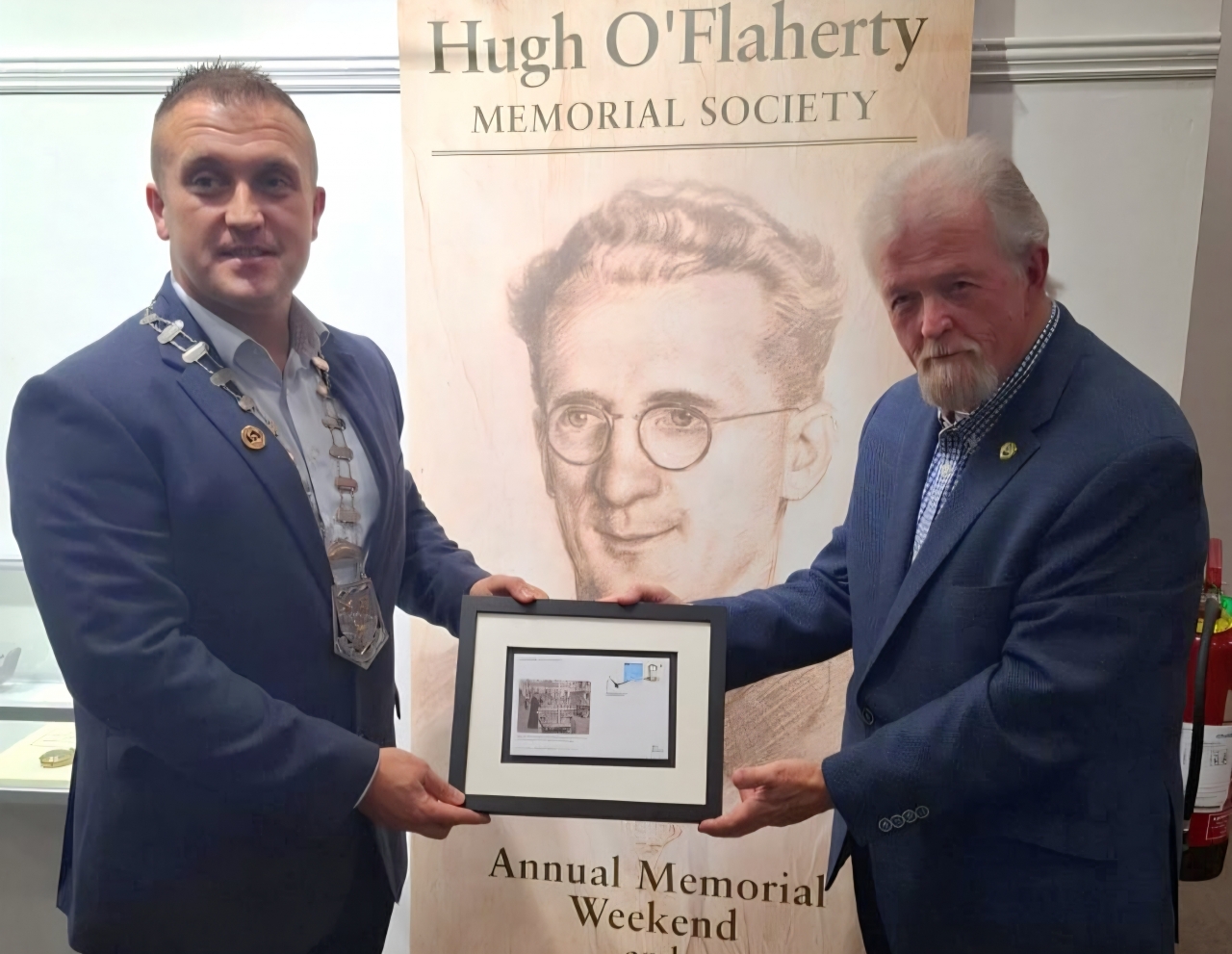

Rare BBC footage screened at Hugh O’Flaherty centenary exhibition

Visitors to the Hugh O’Flaherty Memorial Society Ordination Centenary Exhibition at Killarney Library are being given a unique opportunity to view rare historic footage linked to the Killarney priest’s life […]