News

The chronic undersupply of properties will continue into 2023

By Ted Healy of DNG TED HEALY

Firstly, happy New Year to all our readers, it has been a great privilege for me to contribute here on property related matters every fortnight and I hope that it has proved insightful.

As we begin a new year it is always beneficial to look back before we look forward. The past 12 months in the property market have certainly been eventful. We experienced unprecedented activity post pandemic lockdowns with demand far exceeding supply in all areas. This saw strong prices being achieved in record time frames in the first half of 2022.

The latter half of the year saw dramatic changes in the world economy with the ongoing conflict in Ukraine and rising energy costs, inflation and interest rates. Despite these dramatic events we have not experienced a significant hit to housing demand.

The myhome.ie Q4 Property report, published this week, shows that while asking price inflation may have dropped in Q4, just 3% of homes listed for sale in this period saw asking price reductions which demonstrates a resilience in the market. That said, this resilience will be tested in 2023. Current buyers in the market are now stretched to the largest extend in over a decade, with the average residential purchase now running at 7.7 times’ average wage.

The report shows that asking price inflation has continued to slow, the annual figure is now running at 6% nationally. It is important to note here that while price inflation has slowed, we are not talking about price falls but a slowdown in the level of price increases. The data shows that while there has been some cooling in demand and increased asking price reductions, trading has continued to be resilient with premiums still being paid over and above asking prices.

A very interesting feature of the report is that the average time to 'Sale Agreed' in Q4 was 2.7 months nationwide, which is indicative of a very tight housing market.

MORTGAGE APPROVALS

Average mortgage approvals were up 4.3% on the year. We expect 2023 will see a further slowdown in asking price inflation, although the imminent change in the Central Banks lending rules to allow for borrowings of four times income will provide the market with a boost.

The continuation of supports such as the First Home and Help To Buy Schemes will also help first time buyers in a market that still requires much more stock. While those stock levels are improving gradually on a national basis, they are still not running at levels required to satisfy demand.

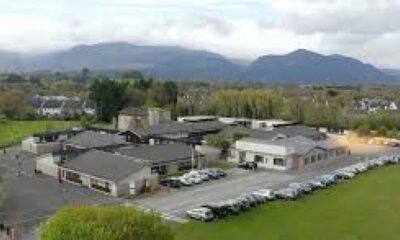

On a local level, the Killarney property market has certainly proved resilient. The past 12 months has seen record prices achieved for varying property types, from three bedroom semi-detached houses to four/five bed detached family homes.

The chronic undersupply of properties to the market will continue in 2023 with demand far exceeding supply. The lack of availability of new homes is a cause of concern. Proposed changes to planning legislation may speed up the planning process but build cost inflation and rising interest rates may weigh on activity.

We expect to see continued demand for properties in the Killarney area from a host of purchasers from first time buyers, retirees, right sizing buyers, holiday home buyers and family home purchasers.

At DNG Ted Healy, we are currently looking for properties in the Killarney area to satisfy these house buyers. The end of 2022 saw us successfully close a large number of sales and we now seek stock for our 2023 purchasers.

If you are considering selling your property in 2023, please get in touch. We would be delighted to meet and speak to you to guide you through the process and advise you on how to best maximise the price of your property.